In Europe, Alcohol prices rose by 9.8 percent over the past year. This may well have influenced European consumers to spend more on beverages to drink at home rather than going out to bars. There has been a similar trend in the US, according to the Drizly consumer study.

eCommerce plays a pivotal role as consumers increasingly turn to online platforms for convenient and personalized Alcohol shopping experiences and providing businesses with new avenues for reaching consumers. The interplay of these trends is reshaping business approaches, encouraging innovation, and emphasizing the importance of adaptability within the European Alcohol sector.

Sparkling wines are on the rise for the festive season

In 2023, the European Alcoholic Drinks market commands a robust €210.5 billion in revenue, signifying a substantial economic force. The Beer segment takes the lead with a market volume of €70.8 billion, followed closely by Ciders, Spirits, Champagne, and Wine. The sector anticipates a compelling 9.81 percent annual growth (CAGR 2023-2025).

During the holiday season in the UK, eCommerce and business strategies align with the popularity of Prosecco, Spirit & mixers, and Champagne. The increasing preference for cocktails is a notable trend, evidenced by an 11 percent rise in cocktail enthusiasts within the on-trade sector in 2022.

In France, mulled wine is popular in bars and at French Christmas markets, but at home, wine and Champagne are traditional holiday season favorites. However, due to the rising prices, champagne will be less present this year, replaced partly by other alcohols, such as sparkling wines, that are on the rise.

Other festive French cocktails include Kir Royale, made from Champagne and Crème de Cassis or blackcurrant liqueur. Another classic is a Sidecar made with citrusy Cointreau and Cognac.

Let's see some other alcohol shopping trends in these two countries, and how brands can stay at the top of consumers’ shopping lists.

A surge in Alcohol eCommerce launches the New Year in the UK and France

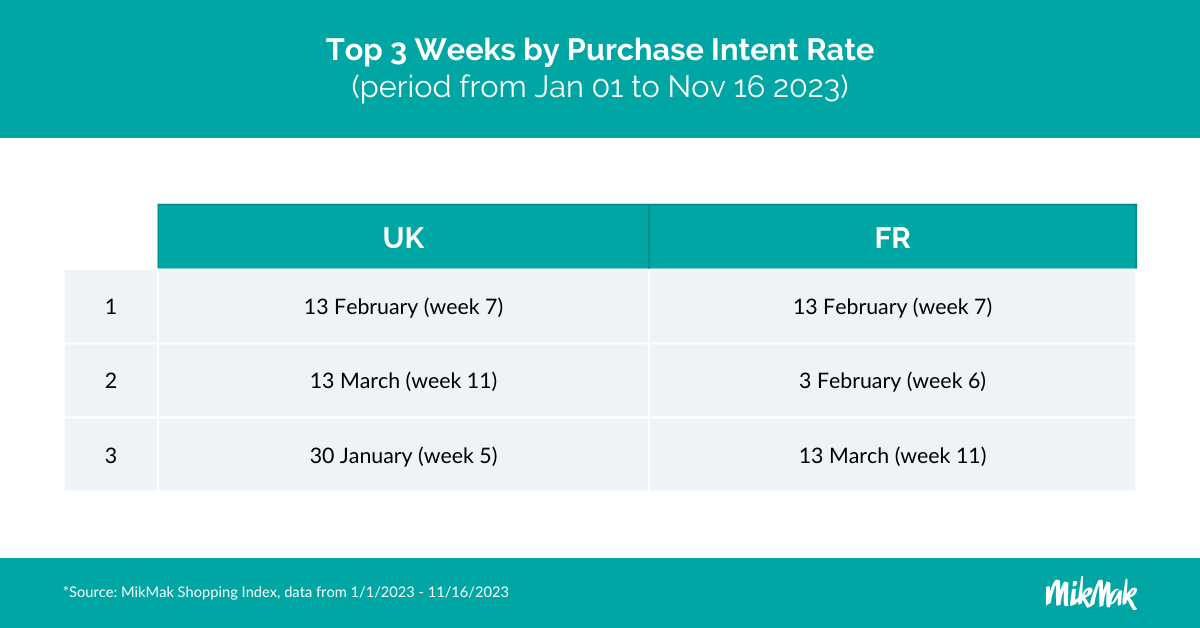

In the French and British Alcohol markets, eCommerce trends reveal interesting patterns this year. For the UK, the months with the highest Purchase Intent Rate, indicating how likely eCommerce shoppers are to purchase, were February, January, and April, according to the MikMak Shopping Index. Similarly, in France, the most favorable months in terms of Purchase Intent Rate are January, March, and May, demonstrating that “Dry January” is not that dry!

The 7th week of the year (13 February) scored the highest conversions, in Purchase Intent Rate, in both countries, with the preceding two weeks (5 and 6), among the top 3 best weeks. Thursday was the best day of the week driving Alcohol shopping.

Understanding and leveraging shopping trends can prove instrumental in maximizing sales, optimizing promotions, and inventory management to align with consumer preferences during these peak months.

Looking at these trends, it seems that Alcohol brands in Europe should not slow or stop campaigning after the end-of-year festive season. Especially for occasion-based opportunities at the beginning of the year, such as Valentine’s Day, St. Patrick’s Day, and the Six Nations rugby championship.

Amazon leads in the UK and Millesima in France for Alcohol shopping traffic

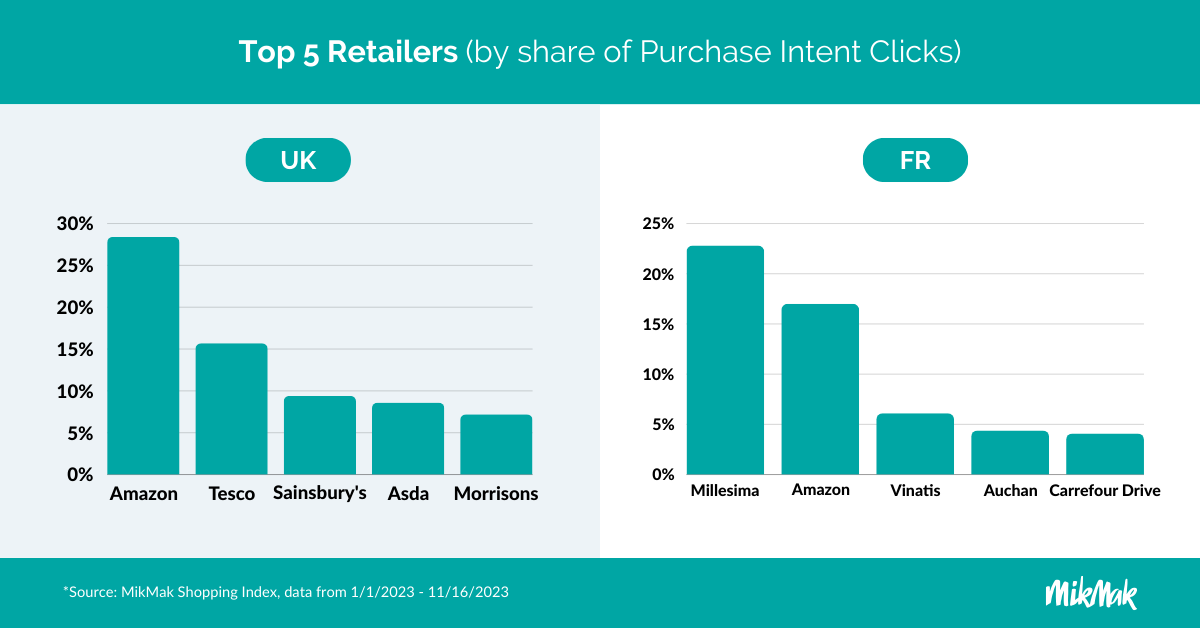

In the ever-evolving market of Alcohol eCommerce in France and the UK, the significance of top retailers is evident through their respective shares of Purchase Intent Clicks, indicating in-market traffic. In the UK, Amazon dominates with a commanding share of 28.4 percent, according to the MikMak Shopping Index, followed by Tesco at 15.7 percent, and Sainsbury's at 9.4 percent. Asda and Morrison’s round the top five retailers with 8.6 percent and 7.2 percent, respectively.

This data underscores Amazon's substantial influence as a preferred platform for Alcohol purchases.

In France, wine and spirits retailer Millesima takes the lead with a notable 22.8 percent share, followed by Amazon at 17.0 percent. Vinatis, another French specialist retailer, is in third position, at 6.1 percent. Auchan, and Carrefour Drive, leading French grocery giants, round the top five with 4.4 and 4.1 percent, respectively.

It is also important to highlight that social media drives the second most in-market traffic for Alcohol, with a 20 percent share of Purchase Intent Clicks in the UK and 37.9 percent in France. Meta is leading social commerce in both regions, according to the MikMak Shopping Index.

Accelerate your Alcohol sales with engaging and shoppable content

User experience is key to driving conversion. Across media and websites, Alcohol brands should make sure that shoppers can find and buy their products faster, online and in-store.

Here are some creative best practices from MikMak, to improve marketing effectiveness:

On Brand websites:

- Simplify checkout by using a clear CTA like “Buy Now”, and make it visible on all your product pages and other pages with high traffic

- Increase convenience by letting your shoppers complete their purchase at any of their preferred retailers, online and offline

- Reduce clicks by displaying both online and in-store checkout options within one user interface

- Personalize selection by using product filters and carousels to make variants and related products discoverable and available to interested shoppers

- Enable shoppable options on your brand website to promote brand awareness and offer additional checkout and fulfillment options for shoppers

For inspiration, here’s how Krug, an LVMH champagne brand, makes their products discoverable in the UK:

On Media:

- Show the product within 3 seconds, the sooner, the better!

- Align content with major holidays and campaign themes

- Highlight unique beverages or flavors

- Call out new products

- Include a CTA to click through/swipe up to shop

- Measure, learn, and optimize at every touchpoint!

- Test lifestyle, carousel, GIF, and video content vs only product images to see which formats drive the most engagement on your different consumer touchpoints

- Utilize MikMak data signals on shopper engagement to determine winning creative for real-time campaign optimization and/or future campaign planning

Bacardi Sapphire showed it well with its new campaign:

Want to see how MikMak can boost your brand’s growth? Check out our new guide, New Year New Me (NYNM), for more Alcohol insights, and request a demo today.