The time has come. Online Alcohol retailer Drizly is shutting down this week, roughly three years after Uber’s acquisition of the company. According to the retailer’s official website, all Drizly consumer-facing operations will be seized on March 28th, 2024.

Historically, Drizly has been a top online retailer of Alcohol brands. In fact, it was cited as the number one online retailer for Alcohol brands reported in our last Alcohol Benchmarks and Insights Guide. So, with its disappearance, where will shoppers shift to? Where should brands be focusing on sending traffic to after Drizly? Here’s what MikMak has found.

Place emphasis on “Quick Commerce” as retailer preference shifts

Rachel Tipograph, MikMak’s Founder and CEO, was interviewed on the Brewbound Podcast about Drizly’s shutdown. In her interview, she mentioned that she believes that “Quick Commerce” checkout options like Instacart, Uber Eats, Doordash, GoPuff, and ReserveBar will absorb Drizly’s market share. With 1 in 10 US consumers ordering Alcohol delivery in the past six months, we highly recommend brands consider these Quick Commerce retailers when planning ahead.

Instacart is posing itself to be the next most popular “Quick Commerce’ destination for Alcohol shoppers

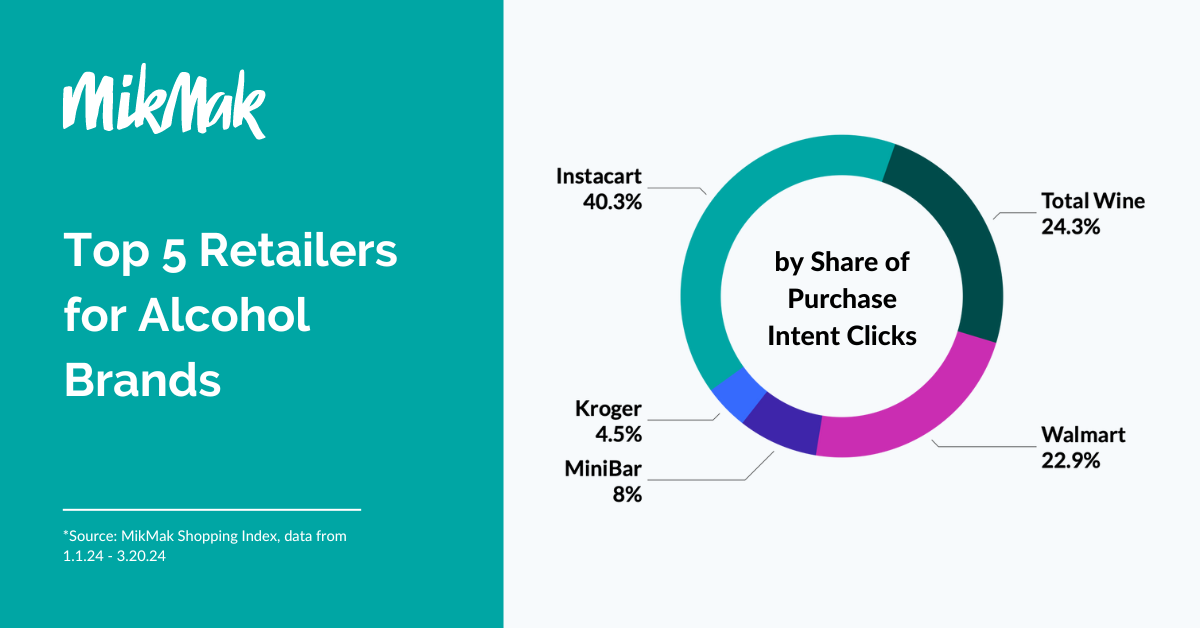

To measure in-market traffic, MikMak uses a metric called Purchase Intent Clicks, which measures the number of times a shopper has clicked through to at least one retailer during a single session. In 2023, Drizly led the charge regarding retailer preference with 41.2 percent of Purchase Intent Clicks, compared to the top five Alcohol retailers at the time. So, with Drizly dissolving as a retailer option, where will that traffic relocate?

According to the MikMak Shopping Index, Instacart is the next leader for Alcohol retailers right now, driving 40.3 percent of Purchase Intent Clicks so far this year, when compared to the other top five Alcohol retailers (excluding Drizly).

Following Instacart, Total Wine drives 24.3 percent of Purchase Intent Clicks. In third is megastore, Walmart with 22.9 percent. Minibar and Kroger round out the top five retailer options for Alcohol with 8 and 4.5 percent, respectively.

We also expect other retailers with last-mile delivery options similar to Drizly, such as GoPuff, Uber Eats, Reserve Bar, and Doordash, to be key players when Alcohol shoppers select their new go-to retailers.

Use MikMak to give your shoppers the option of their preferred retailer

Wherever traffic from Drizly goes, giving your shoppers multi-retailer options at checkout can be crucial to conversion. Why place all of your bets on one destination when you can provide shoppers with more?

MikMak customer Garrison Brothers Distillery improved its marketing effectiveness by utilizing MikMak to ensure every consumer touchpoint was shoppable and enabled shoppers to purchase its products how and where they wanted. This resulted in a 9 percent higher Purchase Intent Rate, which measures the percentage of shoppers who clicked through to at least one retailer or the likelihood of conversion, than the Spirits category average on FB/IG.

To find out how your brands can see results like this, schedule a demo with MikMak today.